Improvements to the PPP Loan Program

By: Vanderbloemen

The President has signed into law "Paycheck Protection Program Flexibility Act 2020" or H.R. 7010. Here are the changes you need to know about.

-

The bill will change the term of the loan from 2 years to 5 years. If any portion of your PPP Loan is NOT forgiven, then it converts into a loan. Previously, that loan was a 2-year loan at 1% interest rate. That loan was to start 4 months after the “Covered Period” of 8 weeks from disbursement. It will carry a 1% interest rate.

-

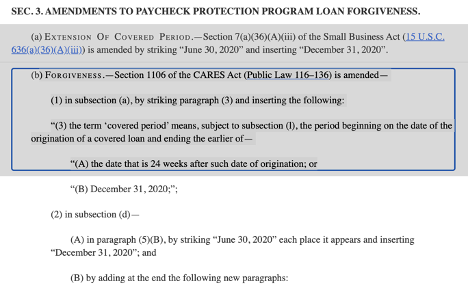

Changes the covered period from 8 weeks to 24 weeks or December 31, 2020, whichever is earlier. Currently, the covered period is 56 days from the date of disbursement. The borrower also has the option to choose an “Alternative Covered Period” which is the 1st day of the 1st payroll period after disbursement. In this period, all of the PPP loan must be spent and non-payroll expenses are capped at 25%.

-

Change in Time to bring back employees to meet FTE requirements to December 31, 2020 (not June 30, 2020). Currently, the borrower has until June 30, 2020, to bring back all FTEs and increase any reductions in salary/wages to participate in

-

The amount of payroll costs that must be used from the PPP loan changes from 75% to 60%. This also inversely allows non-payroll costs (mortgage interest, rent, utilities, and other debt obligations) to move from 25% to 40% of the PPP loan.

-

The bill also increases the exemptions for FTE calculations based on Employee Availability to include:

-

Unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020

-

Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020

-

Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020

-

Within the above three points that the SBA (Administrator) may not limit the non-payroll portion of a forgivable covered loan amount.

-

-

All borrowers will be able to delay their payment of Federal Employer Payroll Taxes. Prior to this action, it was seen that this would be “double-dipping” on the government benefit.

It is pointed out in this legislation that that a borrower does not have to use these new parameters and can submit using the 8 weeks and previously discussed guidelines of the Paycheck Protection Program.

Thursday, May 28, 2020: Improvements to PPP Loan Passes House (H. R. 7010)

House passed an improvement bill to the PPP or Paycheck Protection Program. Here are the details of the bill and what we can anticipate being in the refined bill:

1. Changes the maturity of the PPP loan from 2 years to 5 years

If any portion of your PPP Loan is NOT forgiven, it converts into a loan. Previously, that loan was a 2-year loan at 1% interest rate. That loan was to start 4 months after the “Covered Period” of 8 weeks from disbursement.

If signed into Law: The loan would have a 5-year term at a 1% interest rate.

Proposed New Guidance:

Current PPP Law:

2. Change in covered period

Currently, the covered period is 56 days from the date of disbursement. The borrower also has the option to choose an “Alternative Covered Period” which is the 1st day of the 1st payroll period after disbursement. In this period, all of the PPP loan must be spent and non-payroll expenses are capped at 25%.

If signed into Law: Change in the covered period from 8 weeks to 24 weeks or December 31, 2020, whichever is earlier.

Proposed New Guidance:

Current PPP Law:

3. Change in Time to bring back employees to meet FTE requirements

Currently, the borrower has until June 30, 2020, to bring back all FTEs and increase any reductions in salary/wages to participate in the Safe Harbor for loan forgiveness.

If signed into Law: The date of June 30, 2020, is replaced with December 31, 2020.

Proposed New Guidance:

Current PPP Law:

4. New Exceptions for Employee Availability

If signed into Law: Exemptions based on Employee Availability:

-

Unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020

-

Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020

-

Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020

No Limitations – in carrying out these sections, the Administrator may not limit the non-payroll portion of a forgivable covered loan amount.

5. Delay in Federal Employer Payroll Taxes

If signed into Law: All borrowers will be able to delay their payment of Federal Employer Payroll Taxes. Prior to this action, it was seen that this would be “double-dipping” on the government benefit.

Keep up with the latest CARES Act PPP Updates here.