Clarity On Federal Taxes For CARES Act Paycheck Protection Program

By: Vanderbloemen

By Rene Cargile

Our Vanderbloemen team has been updating you on CARES Act Paycheck Protection Program details each day as we learn more.

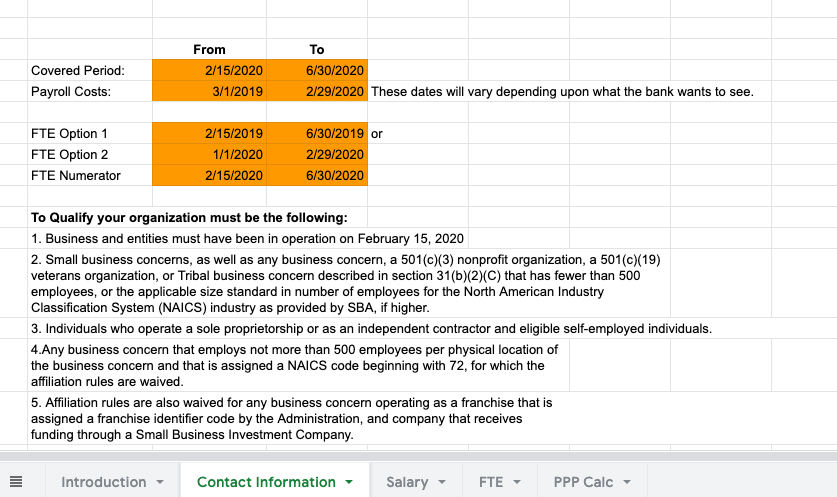

There have been several questions regarding the dates for the payroll costs. At the time we first developed our CARES Act Paycheck Protection Program Loan Calculator Spreadsheet, the CARES Act stated the 12 months prior to the loan. We are hearing from all of you that these dates vary from lender to lender. Most lenders are asking for your 2019 payroll information. So, please know these dates are a variable at this point.

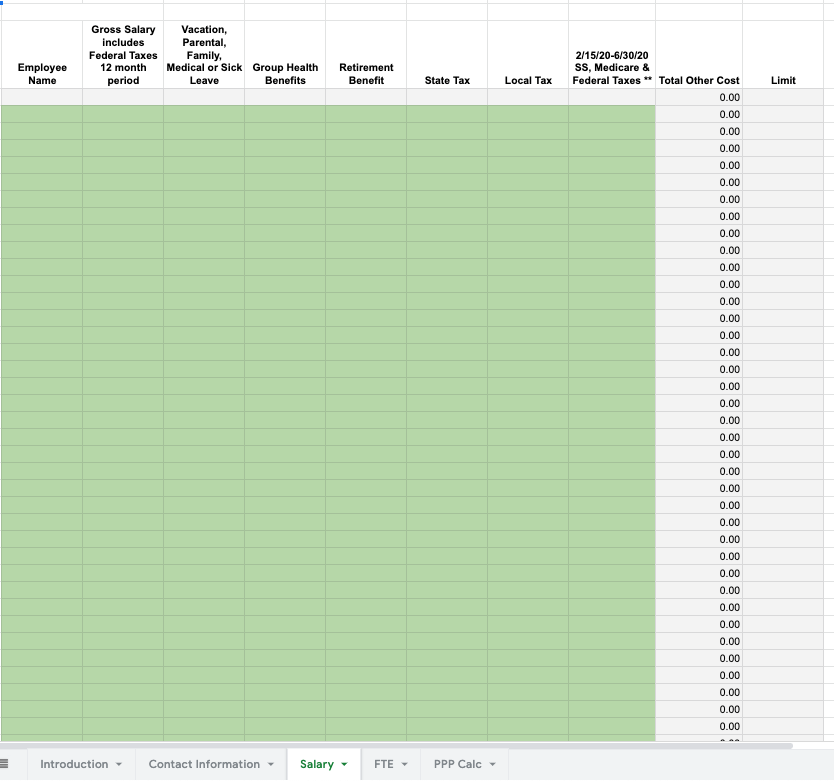

Our COO who has been following the CARES Act closely received word from Senator Tim Scott who was on the task force for the bill that housing allowance is NOT included in the payroll calculation. We have heard that some banks are INCLUDING it in the calculation. I would ask direction from the bank you are using. I have deleted the column from the spreadsheet.

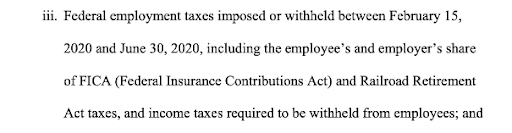

Also, we received a directive from SBA regarding federal taxes. This means if you are using the payroll period that includes 2/15/20-3/30/20 you will need to input the taxes accordingly.

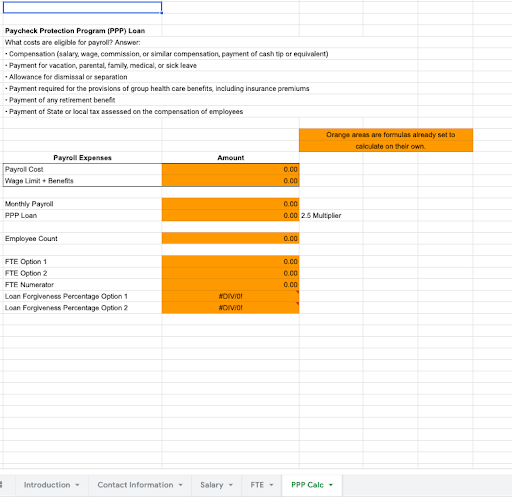

Lastly, many of you have discovered that on the old version(s) of the spreadsheet, the formula in the Loan Forgiveness Percentage Option 2 is incorrect and that it needs to read C26/C25. If it is correct on your spreadsheet then ignore this. Thank you for providing your feedback to us, as it is helping all of us.

The formula for FTE Option 1 FTE!B1/4.5/173.34 Option 2 FTE!C1/2/173.34. We are receiving many questions on how we got to 173.34. Salaried employees work 2080 hours per year/12 months = 173.34. Each period is also different. Option 1 is for 4.5 months and Option 2 is for 2 months.

Thank you again for your help in making this better as we are all learning and updating you as soon as we learn more information.